About Us

Eagle Asset Management is an international management company headquartered in Spain with offices throughout Europe.

-

12 +

years in asset management

-

100 +

clients have trusted us

-

4

representative offices across Europe

We will preserve and grow your capital

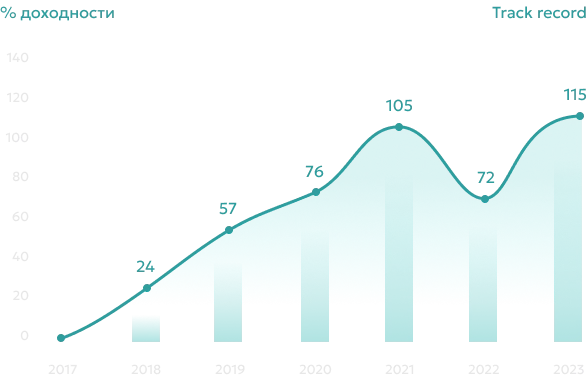

We protect it from inflation, currency fluctuations, and macroeconomic events. Our strategies outperform the market and provide higher returns, stability, and reliability.

What and how we invest in

-

Consumer goods

-

-

Technology

-

-

Service and retail

-

-

Financial sector

-

-

Healthcare

-

-

Industrial goods

-

-

Corporate and government bonds of the US and Europe

-

The portfolio consists of bonds, stocks, and derivatives (depending on the selected strategy) of US stocks included in the S&P 500 index.

The minimum market cap of companies included in the portfolio is $50 billion.

We provide a reliable infrastructure and a wide range of tools to meet your individual needs, giving access to global trading platforms and brokers: Saxo Bank, Interactive Brokers, Lightspeed, Charles Schwab, Freedom Finance, and others.

5 strategies for every goal

Collective service

Balanced Fund

Balanced Fund

-

Investment goalcapital growth

-

Expected return14-16% annually

-

Minimum investment amount$100,000

-

Investment termfrom 1 year

-

Management Fee1.5%

-

Success Fee15%

Individual service

Active investor

-

Investment goalcapital growth

-

Expected return16-18% annually

-

Minimum investment amount$100,000

-

Investment termfrom 1 year

-

Management Fee2%

-

Success Fee20%

Conservative investor

-

Investment goalcapital growth

-

Expected return10–12% annually

-

Minimum investment amount$100,000

-

Investment termfrom 1 year

-

Management Fee2%

-

Success Fee20%

Maximum protection

-

Investment goalcapital growth

-

Expected return8–10% annually

-

Minimum investment amount$100,000

-

Investment termfrom 1 year

-

Management Fee1%

-

Success Fee20%

VIP service

Our clients receive a full range of financial services

-

Investment goalcapital growth

-

Expected return14-18% annually

-

Minimum investment amount$500,000

-

Investment termfrom 1 year

-

Management Fee1.5%

-

Success Fee20%

-

Tailored selection of assets and investment instruments

-

Assistance with documentation for opening a brokerage account

-

Comprehensive financial consulting on capital relocation and tax optimization

-

Capital placement in the US stock market

Other fund products

We work with major global jurisdictions, creating customized strategies tailored to our clients' goals and needs.

-

Corporate structuring

Creation and management of companies, funds, and trusts

-

International tax planning

Tax burden optimization and asset protection

-

Capital succession

Strategic inheritance planning

-

Legal support

Compliance with regulatory requirements across jurisdictions

-

Administrative management

Accounting and corporate administration